There are several ways that immigration advisory businesses may waste time with financing and account management. One significant issue is the use of manual processes, which can be time-consuming and prone to errors. Manual processes can lead to delays in financial reporting and decision-making, alongside difficulties in tracking invoices, payments, and other financial data. A lack of automation can also contribute to these problems, as it can take longer to complete tasks such as reconciling accounts, generating financial reports, and processing payments.

Inefficient financial systems waste time and resources, as errors and inefficiencies can slow down financial processes and make it difficult to track the business’ financial performance.

Immigration Legal Systems

When I engaged with the immigration process, I found it complex and difficult to navigate. Expecting more simplicity for those unfamiliar with the legal system, and procedures to be streamlined to reduce the length of each requirement, I was faced with uncertainty and anxiety. The personal stakes and legal issues encountered during the immigration process establish the necessity of support for the customer and fluid systems.

My own immigration journey prompted me to consider a gap in the market that could be filled by intelligent, cloud-based immigration software for attorneys.

Software Automation Solutions

QuickBooks discusses how financial management software can help your small business, stating how modern financial management automation tools and enterprise resource planning materials excel in their functionality for monitoring and managing financial performance. With an ERP system, QuickBooks predict a reduction in management costs in the long term and the successful bringing together of multiple divisions to make sure policies are always followed.

Considering the benefits of financial management software for SMBs, Marianne Chrisos conveys how contemporary software solutions help plan, organise, direct and control financial activities to minimise the resource needs of account management, aiding in planning through data and financial transparency, and improved compliance. By measuring growth and reducing errors, businesses utilising software automation can lessen inaccuracies and plan better.

Immigration Law Firm Software

Ezymigrate makes financing a breeze by connecting you with an entire case management solution dedicated to considering the needs of your business and clients. From client communication to payment plans, we have you covered with software to eliminate human error.

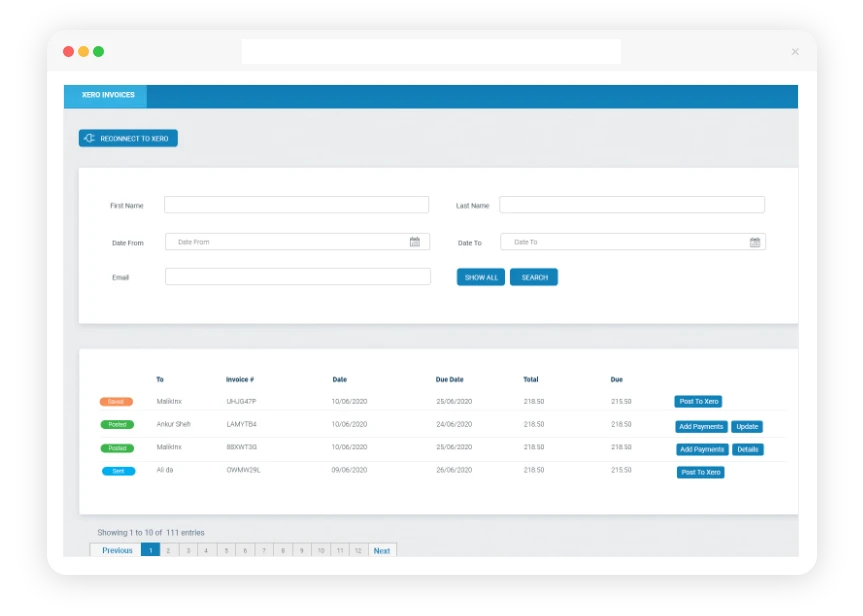

Two-Way Xero Integration

Ezymigrate’s two-way integration with Xero allows you to save your team time with less manual entry and fewer steps in financial processes. The simplicity of our integration with Xero means that you can immediately update all systems with the correct financial information. Find streamlined flows of data between Xero and Ezymigrate to effectively meet the needs of your clients, as the Ezysolution for your business problems.

Business Process Automation

Create professional invoices and receipts with ease. Simply use our software to automatically generate these documents, saving time and effort for you and your staff. Ezymigrate assists in creating, recording, and emailing invoices automatically, and further helps in its two-way integration.

Intelligent Reporting

Proper automation also requires electronic payment recording, which Ezymigrate delivers through an automatic receipt that is generated and sent to the client as well. One of the key advantages of these systems is increased efficiency and, therefore, cost savings. Automated payment reporting can process and transmit payment information much faster than manual systems, resulting in quicker payment processing, fewer delays, and a reduction of labour-intensive processes.

Accuracy is a vital benefit of electronic payment reporting. Reducing the risk of errors and discrepancies, Ezymigrate ensures payments are accurately recorded and reported. Especially important for businesses, inaccurate payment reporting can lead to financial losses and damage to reputation.

Ezymigrate also offers enhanced security, including security measures such as encryption and secure transmission of payment data to help protect against fraud and unauthorised access. In today’s digital age, where data breaches and cyber attacks are becoming increasingly common, Ezymigrate’s encrypted tools are beneficial for businesses.

Another reward of electronic payment reporting is greater convenience. These systems can be accessed from any location with an internet connection, making it easier for users to manage their payments and track their financial transactions through our E-immigration software. Ezymigrate’s convenience is helpful for individuals and businesses with a large number of payment transactions to manage.

Are you an immigration advisor looking to stay competitive and free up time for new clients or to better meet the needs of current clientele? Look no further than Ezymigrate! Our IT software solutions are designed specifically for immigration advisors like you, taking care of repetitive and mundane tasks such as invoicing and accounts so you can focus on what you do best.

With Ezymigrate, you can streamline your work and stay ahead of the competition. Don’t let mundane tasks weigh you down – try Ezymigrate today and see the difference it can make for you!